Ethylene oxide (EO) is a vital chemical compound used extensively in producing various downstream chemicals and consumer products. As a key intermediate in manufacturing ethylene glycol (used in antifreeze and polyester), ethanolamines, and surfactants, ethylene oxide is crucial for industries such as automotive, textiles, personal care, and healthcare. Given its importance, the price of ethylene oxide is highly influenced by factors including global demand, production costs, feedstock prices, and economic conditions.

In this article, we examine recent ethylene oxide price trend, the key factors impacting its market value, and future projections for the global ethylene oxide market.

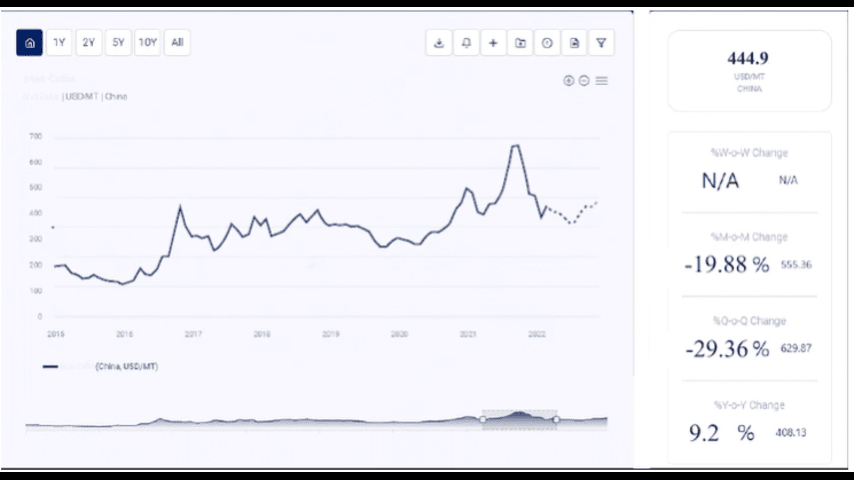

Historical and Recent Ethylene Oxide Price Trends

Ethylene oxide prices have historically shown volatility due to variations in global demand, supply constraints, and fluctuations in feedstock prices, especially ethylene, from which it is derived. The pandemic-induced disruption in 2020 led to significant fluctuations in prices as demand for ethylene oxide-derived products like personal care, cleaning products, and disinfectants surged, while industrial demand slowed.

In the past two years, prices stabilized but were influenced by feedstock price volatility, especially in crude oil and natural gas markets, impacting ethylene production. The global economic recovery and resumption of industrial activity in 2022-2023 have kept demand steady, though prices are still subject to shifts based on factors such as crude oil prices, supply chain issues, and environmental regulations.

Enquire For Regular Prices: https://www.procurementresource.com/resource-center/ethylene-oxide-price-trends/pricerequest

Key Factors Influencing Ethylene Oxide Price Trends

Several factors play a role in determining ethylene oxide prices. Here are the most significant influences:

1. Feedstock Prices – Ethylene and Crude Oil

- Ethylene Pricing Dynamics: Ethylene oxide production depends heavily on ethylene, a product derived from crude oil and natural gas. Ethylene prices are directly affected by crude oil and natural gas prices, making ethylene oxide prices sensitive to fluctuations in these energy sources. For example, any increase in crude oil prices typically raises ethylene prices, resulting in higher ethylene oxide costs.

- Supply of Ethylene: Any disruptions in the production of ethylene, due to outages or maintenance, can reduce the supply of ethylene oxide and lead to increased prices.

2. Demand from Key Downstream Industries

- Polyester and Antifreeze Production: Ethylene glycol, a primary derivative of ethylene oxide, is widely used in antifreeze formulations and polyester production, which is essential for the textile and packaging industries. Strong demand for polyester products and antifreeze can lead to increased ethylene oxide consumption, driving up prices.

- Personal Care and Cleaning Products: Ethylene oxide derivatives are also used in surfactants for personal care and household cleaning products. Demand from these segments can create price stability, especially during periods of heightened hygiene awareness, as seen during the COVID-19 pandemic.

3. Environmental and Regulatory Compliance

- Emission Control and Safety Regulations: Ethylene oxide is a hazardous compound, and its production and handling are subject to strict safety and environmental regulations. Compliance with emission standards requires producers to invest in safety measures and pollution control technologies, adding to production costs. Regulatory changes in major production regions like the U.S. or the EU can significantly affect global pricing.

- Sustainable Production Initiatives: As industries move towards sustainable production practices, producers may face higher costs for implementing eco-friendly processes, potentially impacting ethylene oxide prices.

4. Global Economic and Industrial Activity

- Industrial Production Rates: Since ethylene oxide is crucial for producing several industrial chemicals and materials, overall economic conditions influence its demand. Strong economic growth, particularly in developing regions, leads to higher demand for ethylene oxide derivatives across industries such as automotive, construction, and textiles.

- Consumer Spending and Lifestyle Trends: Increased consumer spending on personal care and cleaning products can indirectly affect ethylene oxide prices, as these products rely on ethylene oxide-based surfactants.

5. Geopolitical and Trade Influences

- Trade Policies and Tariffs: International trade policies, tariffs, and trade tensions between major producing and consuming countries can affect the supply and price of ethylene oxide. For instance, trade barriers between the U.S. and China, both key players in the ethylene oxide market, can disrupt supply chains and influence pricing.

- Supply Chain Disruptions: Supply chain issues, such as port congestions, logistical constraints, or raw material shortages, can lead to price volatility. The COVID-19 pandemic highlighted the sensitivity of global supply chains, affecting ethylene oxide availability and pricing.

Future Outlook for Ethylene Oxide Prices

The future of ethylene oxide prices depends on several evolving trends and market conditions. Below are the key factors shaping the ethylene oxide market outlook:

1. Demand from Sustainable Applications

Growing emphasis on sustainable production and green technologies is likely to influence ethylene oxide demand. There is an increasing push for bio-based ethylene oxide, especially in markets that prioritize eco-friendly products. The demand for green products in sectors like personal care, automotive, and textiles could add upward pressure on ethylene oxide prices as companies transition to more sustainable processes.

2. Expanding Applications in Emerging Markets

As emerging markets in Asia, Latin America, and Africa experience economic growth, demand for ethylene oxide-derived products is expected to rise. These regions are seeing increased investment in infrastructure, automotive, and consumer goods industries, which could drive steady demand for ethylene oxide. Expanding applications in these regions may lead to price stability or potential increases as demand grows.

3. Technological Innovations and Process Efficiency

Producers are likely to invest in technology and innovations to improve production efficiency and reduce costs. Advances in ethylene oxide manufacturing, including energy-efficient methods, could help offset production costs and stabilize prices over the long term. However, initial investments in technology and equipment may lead to short-term price adjustments.

4. Potential Feedstock Diversification

To reduce dependency on ethylene derived from crude oil and natural gas, companies may explore bio-based or renewable ethylene sources. While still in early stages, advancements in renewable ethylene production could alter the cost dynamics of ethylene oxide, potentially reducing its sensitivity to crude oil prices. This diversification could help reduce price volatility in the long term.

5. Regulatory Pressure and Environmental Concerns

As regulatory pressure mounts, especially in developed regions, the cost of compliance is expected to rise. With ethylene oxide production subject to strict regulations, increased compliance costs may result in upward pressure on prices. Furthermore, any changes in environmental standards aimed at reducing emissions in the petrochemical sector could impact production costs and influence global pricing trends.

Ethylene oxide remains a critical industrial compound, with demand tied closely to its downstream applications across diverse sectors. While prices are currently stabilized, they are influenced by a combination of feedstock prices, industrial demand, regulatory requirements, and economic conditions. The growth of sustainable and renewable production processes, coupled with emerging market demand, is expected to shape ethylene oxide prices in the coming years.

As industries continue to prioritize sustainable practices, the demand for green ethylene oxide production may impact future pricing structures, offering both challenges and opportunities. Businesses involved in ethylene oxide production and consumption should monitor these trends closely, as they present strategic implications for procurement, production costs, and market positioning.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email: [email protected]

Toll-Free Numbers:

- USA & Canada: +1 307 363 1045

- UK: +44 7537171117

- Asia-Pacific (APAC): +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA